Dependent Care Flexible Spending Account Limits 2024. Here, a primer on how fsas work. Dependent care fsa limits for 2024 the 2024 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households.

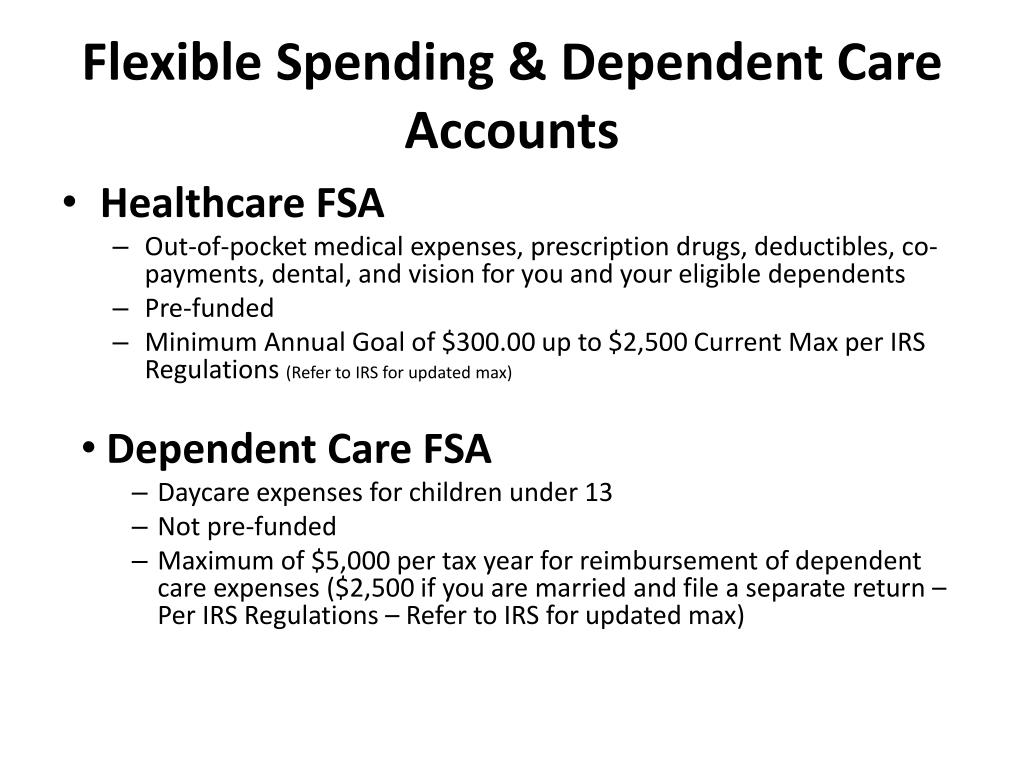

Dependent care fsa limits for 2024 the 2024 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households. Updated on january 4, 2024.

Dependent Care Flexible Spending Account Limits 2024 Images References :

Source: www.care.com

Source: www.care.com

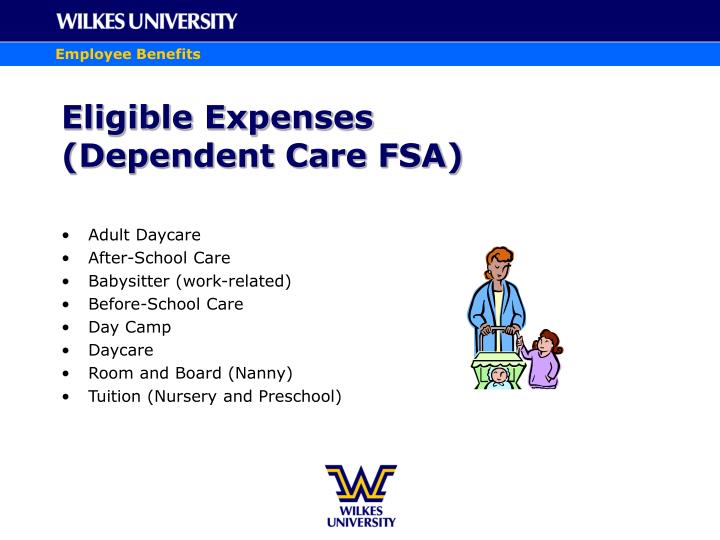

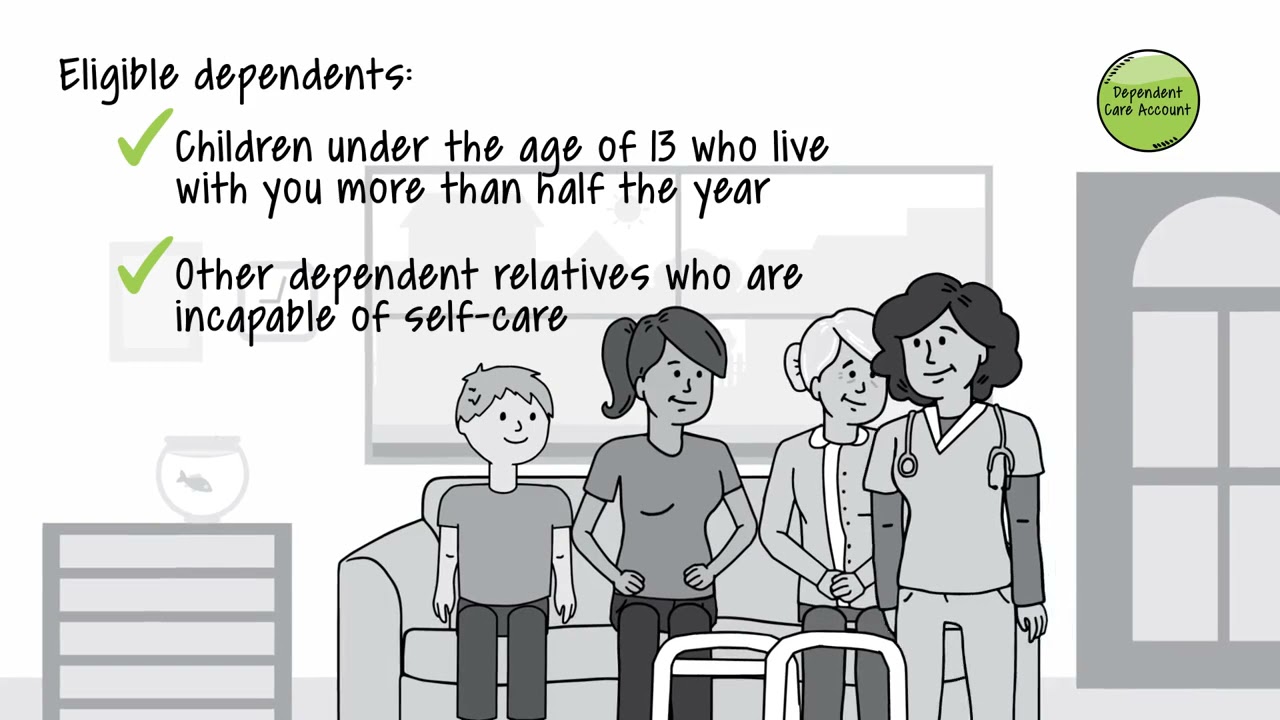

What is a Dependent Care Account? 2024 Inhome Care Expenses, Health and welfare plan limits (guidance links here and here) 2023:

:max_bytes(150000):strip_icc()/dependent-care-fsa_final-c8b6b245dc45448aa7538bb91a854bb8.png) Source: philipawgerrie.pages.dev

Source: philipawgerrie.pages.dev

Fsa Limits 2024 Dependent Care Tera Abagail, It explains how to figure and claim the credit.

Source: www.youtube.com

Source: www.youtube.com

2024 Medical and Dependent Care Flexible Spending Account, $5,000 for married couples filing taxes jointly.

Source: www.slideserve.com

Source: www.slideserve.com

PPT to NEO A&M College PowerPoint Presentation, free download, The internal revenue service announced that the health care flexible spending account (fsa) contribution limit will increase from $3,050 to $3,200 in 2024.

Source: www.cu.edu

Source: www.cu.edu

Dependent Care FSA University of Colorado, Dependent care fsa limits for 2024 remain at $5,000 for single filers or married couples filing jointly, and $2,500 for married individuals filing separately.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Flexible Spending Accounts PowerPoint Presentation ID1249834, Dependent care fsa limits for 2024 the 2024 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households.

Source: www.youtube.com

Source: www.youtube.com

TRIAD DCFSA (Dependent Care Flexible Spending Account) Overview YouTube, The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care.

Source: www.pinterest.com

Source: www.pinterest.com

Flex Spending Account OR Child Care Credit? How to get the most tax, A dependent care flexible spending account (dcfsa) allows qualified individuals to pay for child and dependent care expenses.

Source: www.financestrategists.com

Source: www.financestrategists.com

Dependent Care Flexible Spending Accounts (DCFSA), Health and welfare plan limits (guidance links here and here) 2023:

Source: www.youtube.com

Source: www.youtube.com

Dependent Care Flexible Spending Account (DCFSA or DCAP) Basics YouTube, Here's a breakdown of dcfsa contribution limits:

Category: 2024